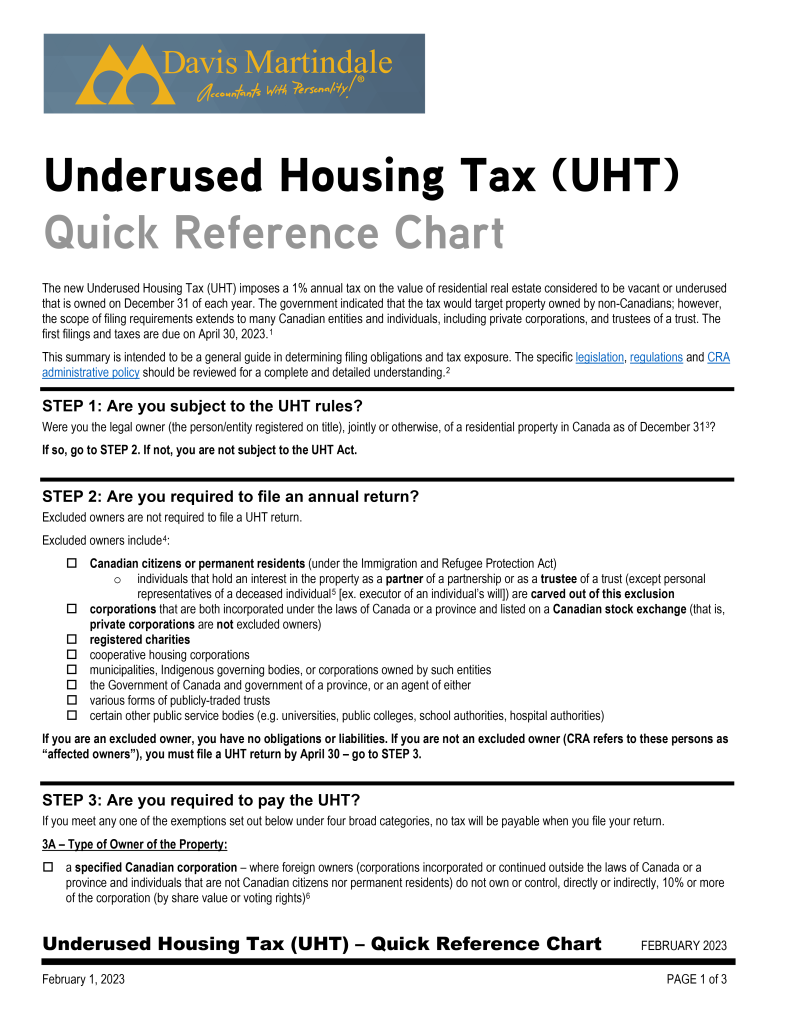

2022 Underused Housing Tax Checklist

Our 2022 Underused Housing Tax Checklist can be used to help gather your documents and send us necessary information for completing your tax return.

*Important Note: “To provide more time for affected owners to take necessary actions to comply, the Minister of National Revenue is providing transitional relief to affected owners. The application of penalties and interest under the UHTA for the 2022 calendar year will be waived for any late-filed underused housing tax (UHT) return and for any late-paid UHT payable, provided the return is filed or the UHT is paid by October 31, 2023.

This transitional relief means that although the deadline for filing the UHT return and paying the UHT payable is still April 30, 2023 [May 1st since April 30th falls on a weekend], no penalties or interest will be applied for UHT returns and payments that the CRA receives before November 1, 2023.”

Learn more: Penalties waived for 2022 UHT return as long as UHT return filed or UHT paid by October 31, 2023.

Please click on the image to download the fillable PDF.