Bill C-9 (First Reading in the House of Commons on November 2, 2020) provides legislation for the Canada Emergency Rent Subsidy (CERS) that was first announced on October 9, 2020.

Below is an overview of the program. For full details, see:

https://www.canada.ca/en/department-finance/news/2020/11/canada-emergency-rent-subsidy.html

The CERS provides direct subsidy relief to businesses, non-profits and charities that continue to be economically impacted by the COVID-19 pandemic. It is applicable in respect of rent and certain property expenses paid for qualifying periods commencing September 27, 2020 and until December 19, 2020. There is a further extension of the CERS program to June 2021, however, no details have been provided at this time.

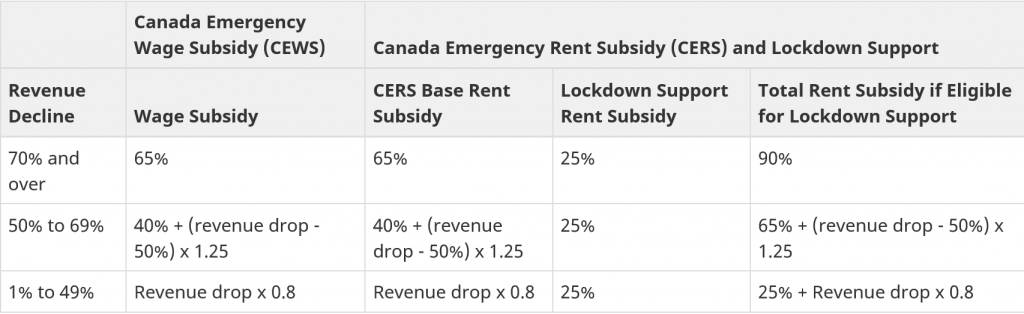

Generally speaking, the CERS is available where an eligible tenant or property owner has experienced a decline in revenues. The base subsidy available – which varies according to the extent of the revenue decline – is up to 65% of qualifying rent and property expenses for each four week qualifying period (to a maximum of $75,000 of expenses per qualifying period, and $300,000 of expenses cumulatively). An additional 25% top-up subsidy applies where the tenant or property owner’s business or activity ceases for at least one week due a public health restriction such as a lockdown.

The CERS legislative provisions share many of the same definitions and conditions that apply to the Canada Emergency Wage Subsidy (CEWS).

Who and What is Eligible?

- “Eligible entities” include individuals, taxable corporations, partnerships, non-profit organizations and registered charities. Public bodies are not

- The entity must have had a CRA Business Number on September 27, 2020.

- “Qualifying property” includes real or immovable property in Canada that is owned or rented by an eligible entity, and used in the course of its ordinary activities. Residential property used by the eligible entity or a non-arm’s length does not

What Types of Expenses Qualify?

Rented Property

- General rules

- In order to qualify, amounts must be paid under the terms of a written agreement entered into before October 9, 2020;

- There is a maximum of $75,000 of expenses allowed per qualifying period (see below);

- There is an cumulative maximum of $300,000 of expenses for all qualifying periods, to be shared among affiliated entities; and

- Any arm’s length reimbursements of expenses, eg., sublets, are to be excluded.

- Qualifying expenses include:

- Rent, including rent based on a percentage of sales, production, etc.;

- Operating expenses paid under a net lease agreement, , i.e., insurance, utilities, common area expenses, etc.; and

- Amounts received by the lessor under the Canada Emergency Commercial Rent Assistance program that were applied against the rent payable.

- Qualifying expenses exclude:

- Sales tax;

- Amounts paid in respect of damages;

- Amounts paid under a guarantee, indemnity, etc., arising due to default of the agreement, including penalties and interest, etc.; and

- Amounts paid for special services.

Owned Property

- Excludes property that itself is used to earn rental income from an arm’s length party.

- Qualifying expenses include:

- Mortgage interest (subject to certain limitations)

- Insurance; and

- Property taxes.

How does an Eligible Entity Qualify?

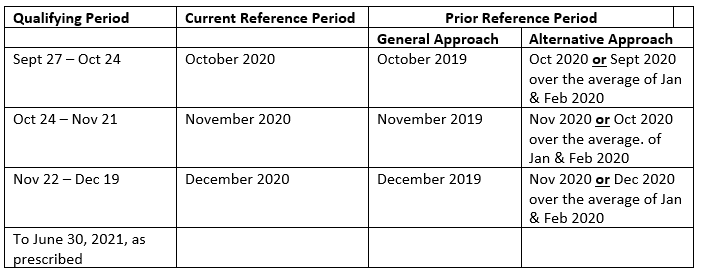

In order for an eligible entity to qualify for the CERS, it must experience a decrease in its revenue when compared to certain prior periods. “Qualifying revenue” for the CERS is the same as that used for the CEWS. The relevant “qualifying periods”, “current reference periods” and “prior reference periods” for the CERS are identical to those used for the Period 8 to 10 base CEWS calculation. To qualify for the CERS top-up subsidy, an eligible entity must be subject to a lockdown for at least one week (see “public health restriction”, below).

CERS Rate Structures

The following chart provides a summary of the maximum subsidy between September 27 and December 19, 2020: