Our Canada Emergency Wage Subsidy (CEWS) Program overview has been updated to include changes introduced in Bill C-9 (First Reading in the House of Commons on November 2, 2020).

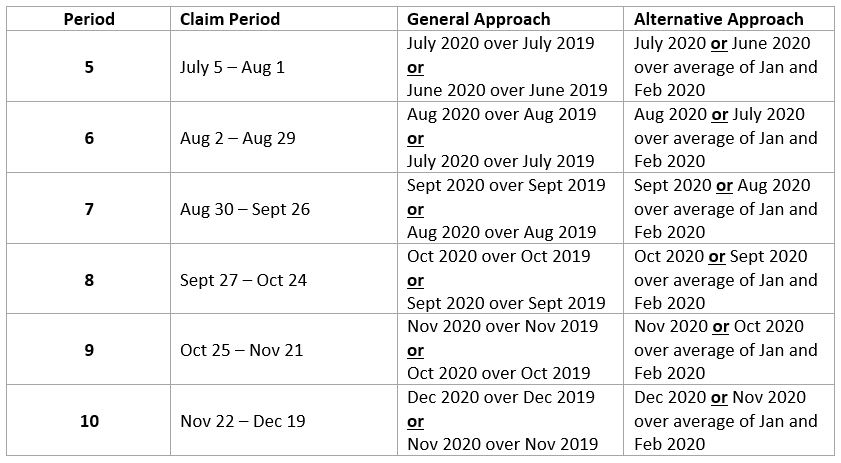

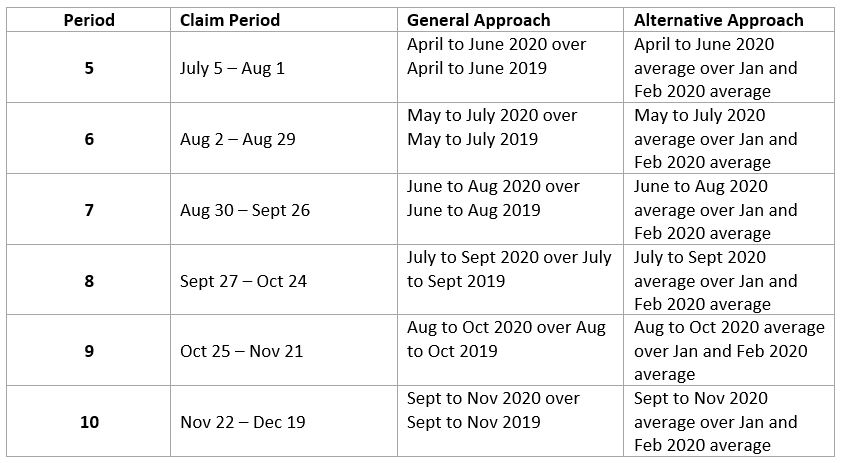

Draft legislation for the extension of the CEWS was released on July 17, 2020, with further revisions announced October 9, 2020. The extended program, which commences with Period 5 (July 5, 2020), also has significant modifications that expand eligibility to all employers with revenue declines, including those that do not meet the 30 % revenue decline threshold that remains relevant for periods 1 through 4 (March 15 to July 4, 2020).

Below is a brief overview of the significant changes. For full details see https://www.canada.ca/en/department-finance/news/2020/11/details-on-the-canada-emergency-wage-subsidy-extension.html

*NEW* Form PD27 – 10% Temporary Wage Subsidy Self-Identification Form for Employers

In addition to the legislative changes, the Canada Revenue Agency has announced that employers who are eligible for either the CEWS or the Temporary Wage Subsidy for Employers (TWSE) must file new “Form PD27 – 10% Temporary Wage Subsidy Self-Identification Form for Employers” with the CRA by December 31, 2020.

For additional information and how to file Form PD27, please refer to https://www.canada.ca/en/revenue-agency/services/subsidy/temporary-wage-subsidy/tws-reporting.html

Changes Specific to Bill C-9

Further Extension and Expansion of Program

Previously extended to December 19, 2020, the CEWS program is now permitted to be extended to June 2021. However specific details for any qualifying periods commencing after December 19, 2020 have not been announced.

The rates for the base CEWS and top-up subsidy for Period 10 (November 22 to December 19, 2020) remain the same as for Periods 8 and 9.

“Safe harbour” rules for Periods 8 to 10 ensure that the top-up subsidy rate is not lower than the rate that would be calculated under the three month revenue decline test.

The definition of baseline remuneration is modified to accommodate seasonal employees and employees returning from leave.

Amendment to Filing Deadline

The CEWS application deadline is modified to be the later of January 31, 2021 and 180 days after the end of the particular qualifying period.

Amending or Revoking Elections

Eligible employers may now amend or revoke an election made if done so on or before the filing deadline for the first qualifying period to which the election applies. Where a claim will be made for periods 1 to 4 and the election is required to be made for all qualifying periods, this deadline would be January 31, 2021.

Other Changes and Corrections

Other changes include the broadening of eligibility where an employer has purchased the assets of a business, expansion to include employees employed primarily in Canada, and a technical correction to certain elections relevant to employer groups.

Detail of All Changes Extending and Expanding the Program

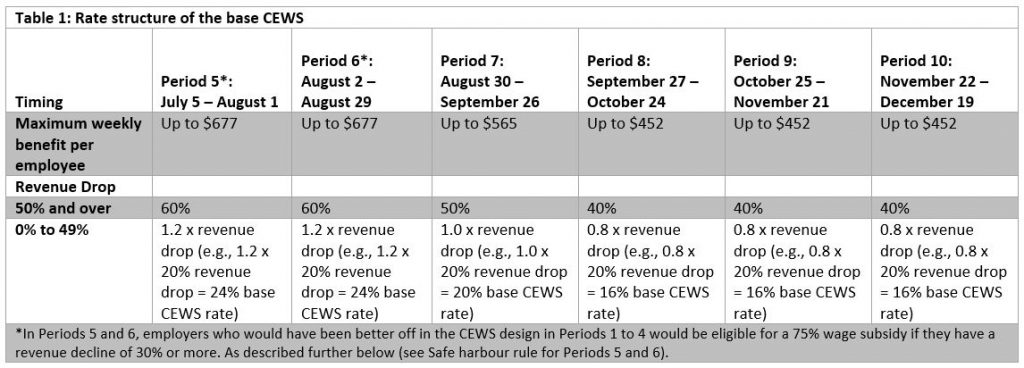

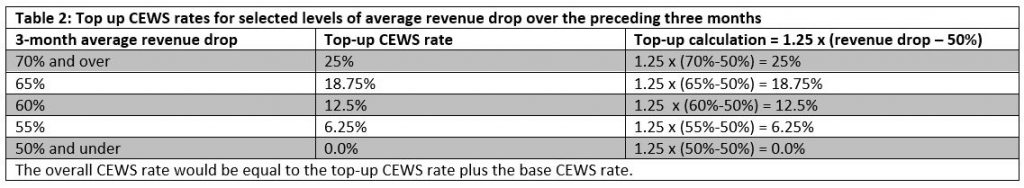

Effective for periods starting July 5, 2020 (claim period 5), there are extensive changes to the subsidy rate and revenue thresholds. Under these changes, CEWS for eligible employees who are active, i.e., not furloughed, will continue in two parts: a base CEWS and a top-up CEWS. As announced on October 9, 2020, the base CEWS for periods 9 and 10 (October 25 to December 19, 2020) remain at the same rate as Period 8.

Base CEWS

The subsidy rate for the base CEWS will vary depending on the level of revenue decline. The maximum base CEWS results where revenues decline 50% or more as compared to the prior reference period. See Table 1 for details.

A “safe harbour” rule ensures that, for claim Periods 5 and 6 (only) eligible employers will be entitled to at least the 75% CEWS rate available under the Period 1 through 4 rate structure (see our summary of original CEWS program for further details https://www.davismartindale.com/updated-cews/). For example, if the eligible employer qualified under original CEWS program for the 75% CEWS, the CEWS rate that could be claimed for Periods 5 and 6 will be the greater of 75%, and the amount determined under the new CEWS rate structure.

Under a separate CEWS rate structure for furloughed employees, the subsidy calculation will remain the same for claim Periods 5 and 6 as it was for Periods 1 to 4. Beginning in Period 7, CEWS for furloughed employees will be adjusted to align with CERB and/or EI benefits.