Understanding Accounting Concepts: Current Ratio

Understanding Accounting Concepts: Current Ratio

In this blog, we discuss Current Ratio Analysis and how it can be utilized in the context of business valuations and income for support reports.

What are ratios? Why are they such an important tool used by Chartered Business Valuators to assist them in calculating the value of a business or income for support? In short, a ratio is a calculation that shows the relationship between two or more amounts.

In this blog, we will take it one step further and discuss the significance of current ratios: the relationship between current assets and current liabilities.

Ratio Analysis

Financial statement analysis involves using the financial results of a company to evaluate a company’s performance and overall financial health. One of the most common methods of financial statement analysis is ratio analysis. Ratio analysis involves constructing ratios using financial results, so that the company’s financial health may be compared across time, industries and to comparable companies. Key ratios are commonly calculated for following performance indicators:

- Profitability

- Liquidity

- Asset management

- Solvency

We will focus on what could be considered one of the most important measures of a company’s liquidity, the current ratio. When we talk about liquidity in the context of a business, we are referring to a company’s ability to pay down its short-term liabilities as they come due.

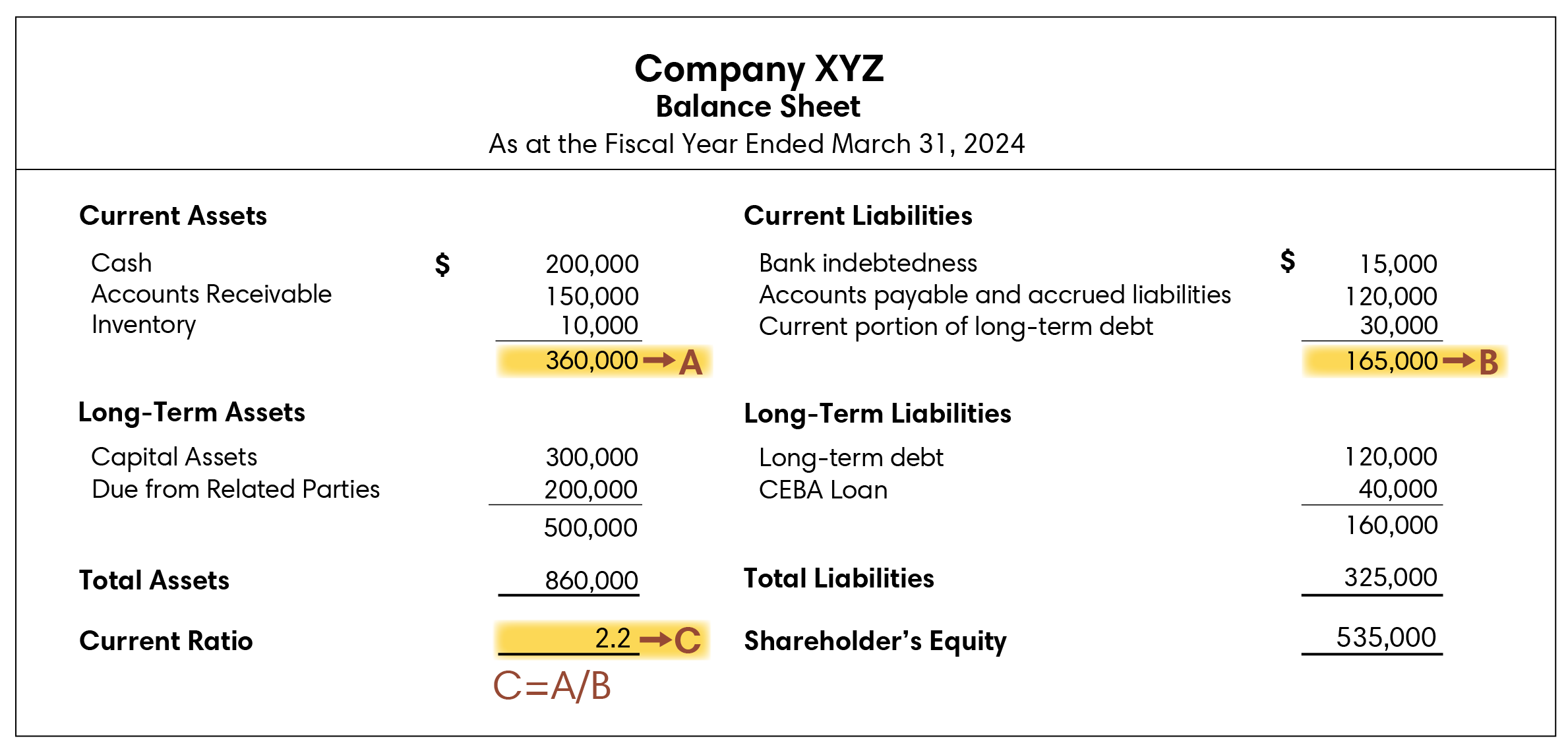

First of all, let’s look at an example of how the current ratio is calculated:

The current ratio is calculated as follows:

Current ratio = Current Assets / Current Liabilities

As shown in the above example, Company XYZ has a current ratio of 2.2, meaning that for every $1 of liabilities, Company XYZ has $2.20 in assets.

In general, the higher the current ratio, the better – but this is not always the case. The current ratio that a company maintains is dependent on the industry in which the company operates. Comparing financial results and ratios to industry leaders and competitors is what is known as benchmarking.

Let’s look at the restaurant industry, for example. Restaurants operate on a cash basis and carry limited inventory, therefore, a nominal current ratio is normal. Conversely, a current ratio that is high in comparison to industry benchmarks may indicate assets are not being managed as efficiently as they could be.

Applications in Business Valuations

Current ratio analysis can be a powerful tool in business valuations because industry benchmarks tell the valuator what a typical industry participant’s balance sheet might look like.

Referring back to our example above, let’s assume Company XYZ is a restaurant, and industry data indicates the average current ratio for restaurants comparable to that of Company XYZ is 1.1. Given Company XYZ’s current ratio of 2.2, Company XYZ is operating with a current ratio that is twice as high as the industry average. This indicates that some of Company XYZ’s current assets may be redundant, and their tangible asset backing may require an adjustment to remove the redundant portion of current assets.

While current ratio industry benchmarking can give an indication of a company’s comparative financial liquidity, it’s not the be-all and end-all of current ratio analysis. For example, a company may require a cash reserve for certain periods of the year in which expenses are high and revenues are low. In this case, it may be necessary to maintain a higher current ratio to sustain operations for this period.

As is the case with any step in determining a company’s fair market value, current ratio analysis requires a high level of professional judgement on the part of the valuator, as well as discussions with a company’s management team to better understand the company’s operations.

Applications in Family Law

Current ratio analysis can also play a role in determining a business owner’s income available for support through a corporation.

The Federal Child Support Guidelines dictate that all or some of the corporate pre-tax income may be available for support purposes. When analyzing a company’s income, it is important to understand the amount that a company can afford to withdraw, and accordingly, what could be considered income available for support.

In practice, when determining the funds that a company can afford to have withdrawn, a valuator may look at current ratio industry benchmarks. This allows the valuator to determine how much of the company’s income could be withdrawn so that it is still able to maintain a current ratio that is line with industry standards. The theory being: if too many assets are removed from the company, this could be damaging to the company’s operations. In other words, by engaging in current ratio analysis, a valuator is aiming not to, “kill the goose that lays the golden eggs” as noted in paragraph 58 of Kowalewich v. Kowalewich, 2001 BCCA 450.

If you need help navigating the complicated areas of business valuation or income calculation, the experts at Davis Martindale can help you. Give us a call today for a personalized discussion.

Co-Authors

Louise Poole

CPA, CA, CBV, CFF

Partner

Valuation & Litigation

Mike Bushell

Associate

Valuation & Litigation

Work With Us

Our Valuation Advisors are ready to have

a personalized discussion with you.