Introduction to Personal Tax in Canada – Part I

Introduction to Personal Tax in Canada – Part I

In this blog, we introduce the common sources of personal tax in Canada, and shed some light on the nuances of their tax treatments.

(Updated with current content from our original post on March 10, 2020)

Despite the recent push towards the promotion of financial literacy education in Primary and Secondary Schools, many Canadians feel in the dark when it comes to understanding personal income taxes. A 2019 poll conducted by CIBC[1] indicated that more than half of Canadians are unaware they are required to pay tax on interest income earned on an everyday savings account. The same poll concluded that 77% of Canadians are unaware that dividends and capital gains may be taxed at lower rates than other sources of investment income.

With the goal of promoting financial literacy and a better understanding of the rules surrounding Canadian Taxation, please join us as we discuss the common sources of personal tax in Canada.

Federal Budget

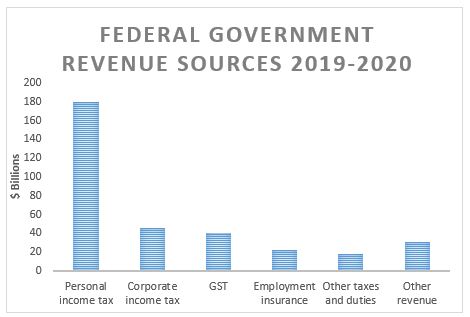

Due to the Covid-19 pandemic, the release of the 2020-2021 Federal Budget has been postponed. However, we include an excerpt of the 2019-2020 Federal Budget to highlight the main sources of Federal Government revenue:

Employment Income vs. Self-Employment Income

While subtle, self-employed persons have slightly different tax consequences than regular employees. The income tax rates are identical; however, self-employed persons are required to make twice the contribution toward the Canada Pension Plan (“CPP”) (10.50% vs. 5.25%). The slightly better news is that they may not be required to contribute to Employment Insurance (“EI”), unless they specifically opt in. Of course, this also means they are not eligible to collect EI if things take a turn for the worse.

Commissions and Other Employment Income

Treated the same as regular employment income – income taxes and source deductions (CPP and EI) are required to be deducted from commissions earned and other employment income.

Interest and Other Investment Income

Interest, foreign interest and dividend income, foreign sourced income, foreign sourced non-business income and certain other income are all reported on this section of your tax return. Financial Institutions may not issue you a T5 slip if your interest income is less than $50, but you must still report this income on your tax return.

Capital Gains vs. Taxable Capital Gains

Generally, when you sell a capital asset for more than you paid for it, you trigger a capital gain. The capital gain is equal to the difference between what you purchased the asset for, and what you sold it for. In Canada, at the time of writing, only 50% of the capital gain is taxable as income. So in short, a Capital Gain is the full amount of the proceeds less the initial cost, and a Taxable Capital Gain is the portion of the capital gain subject to income tax.

Some exceptions to the general rule include listed personal property, certain types of depreciable assets used in a business, and a home or cottage to which the principal residence exemption applies.

Conclusion

The first part of our two part series introduces some of the common sources of personal tax in Canada. Please join us in the next two weeks as we take a deeper dive into three of the more complicated areas of taxable income in Canada – dividends, support and old age security.

If you are having difficulty navigating the world of Canadian Taxation, you’re not alone. Give the experts at Davis Martindale a call – we have experience working with clients of all knowledge levels.

Co-Authors

Ron Martindale

BASc, CPA, CA, CBV, CFF

Partner

Valuation & Litigation

Robin Morrison

CPA

Associate

Valuation

Disclaimer – The information provided in this publication is intended for general purposes only. Care has been taken to ensure that this information herein in accurate, however, no representation is made as to the accuracy thereof. The information should not be relied upon to replace specific professional advice.

Information Sources:

[1] http://cibc.mediaroom.com/2019-04-04-Canadians-still-love-tax-refunds-even-if-it-is-a-sign-of-poor-tax-planning-CIBC-Poll

Work With Us

Our Valuation Advisors are ready to have

a personalized discussion with you.