Valuing Employee Stock Options

Valuing Employee Stock Options

In this blog, we discuss what stock option are, why companies use them as a form of compensation, and key factors to consider when valuing stock options.

(Originally Posted September 17, 2018)

News stories chronicling the rise of corporate executives and their large seven- or eight-figure compensation packages make it seem like employee stock options are only a concern of the wealthy. But employee stock options and other deferred compensation programs are a regular part of many Canadians’ employment agreements, and knowing what they are and how they work is essential in understanding how stock options affect your net worth.

What are Employee Stock Options?

A stock option is a financial instrument that gives the holder the right to either buy or sell shares of a company at a specified price (the “exercise price” or the “strike price”). Options can either be:

- “Call options,” which gives the holder the right to buy shares at the exercise price; or

- “Put options,” which gives the holder the right to sell shares at the exercise price.

As a part of employee compensation packages, companies sometimes award call options to employees.

For example, if Robert has 100 call options on his employer’s shares with an exercise price of $14, he has the right to exercise his options and buy 100 shares of his employer’s shares at a total cost of $1,400, regardless of the actual price of his employer’s shares.

There are a wide variety of stock options available, with two broad categories being the “European” and “American” options. European options can only be exercised on the expiration date of the option, whereas American options can be exercised at any time up to and including the expiration date.

Why Do Companies Use Call Options as Compensation?

A major reason for providing call options as a part of compensation is that it aligns the motivation between employees and business owners. In a corporate environment, one of the main motivations of a business owner is to maximize future profits and thereby increase the value of the company’s shares. By providing employees with call options, it provides employees with an incentive to maximize profits as their call options become more valuable when the company’s overall value increases. To understand why, it’s important to understand why options have value.

Why Do Call Options Have Value?

There are many intricate methods to determine the value of a call option, but a simple illustration may be helpful.

Consider Robert’s situation again, where he has 100 call options on his employer’s shares with an exercise price of $14. If his employer’s shares are currently trading at $15 per share and Robert has the option to purchase them at $14 per share, Robert may want to consider exercising his options as the options are considered to be “in the money.” By exercising his options, he would be able to purchase the shares at $14 each (even though they’re actually worth $15 each). He could then sell the shares for $15 each, earning an instant profit of $1 per share.

Alternatively, if his employer’s shares are trading at $13 per share and Robert has the option to purchase them at $14 per share, it would not make sense to exercise his options as they are considered to be “out of the money.” He would be better off to buy his employer’s shares directly at $13 per share, rather than exercising his options and paying $14 per share.

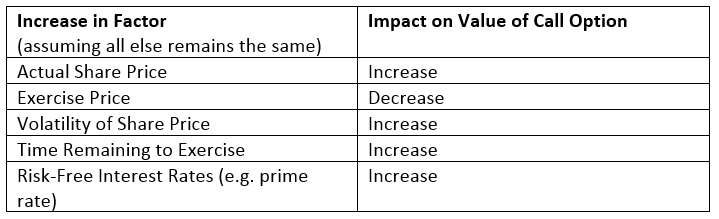

The value of a call option, therefore, is essentially determined by both the likelihood that the option will be in the money, and the depth to which it will be in the money. Key determinants include the following:

Although these guidelines are an excellent starting point, determining the exact value of employee stock options is an intricate process. At Davis Martindale, we are experienced in providing employee stock option and other deferred compensation arrangements valuation reports. If you need a valuation of your stock options, the experts at Davis Martindale would love to work with you.

You may also be interested in our other blogs on stocks:

Co-Authors

Ron Martindale

BASc, CPA, CA, CBV, CFF

Partner

Valuation & Litigation

Louise Poole

CPA, CA, CBV, CFF

Partner

Valuation & Litigation

Work With Us

Our Valuation Advisors are ready to have

a personalized discussion with you.