Pension Equalization in Boston v. Boston

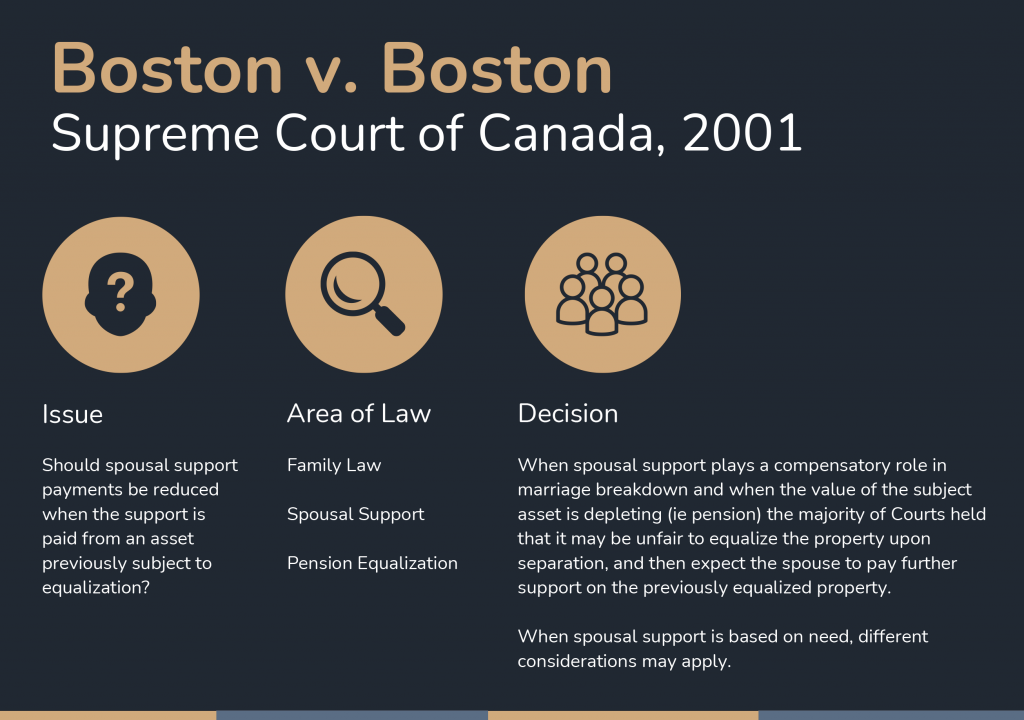

Boston v. Boston

When spousal support plays a compensatory role in marriage breakdown and when the value of the subject asset is depleting (i.e. pension) the majority of Courts held that it may be unfair to equalize the property upon separation, and then expect the spouse to pay further support on the previously equalized property.

I confess that there is one word which, given the choice, I would prefer not hearing in a matrimonial proceeding: ‘pension’ (Lurincic v. Lurincic, 1998)

Pensions are unique financial assets – unlike a car or a house, a pension is not a physical asset, and unlike a business or stock portfolio, a pension cannot be sold or transferred to third parties. In the most basic sense, a pension is a present right to a future stream of income. This complexity has caused debate among the legal and accounting communities about whether a pension is property (a capital asset), income (a maintenance asset), or a combination of both.

Despite this continued debate, it is the view of the Ontario courts that a pension should be viewed as a capital asset prior to vesting. In other words, a pension should be included in the value of net family property and subject to equalization. This approach, however, creates its own problem: If a financial asset (such as a pension) is equalized upon separation, how should the Courts treat the future income streams? Should this income be considered available to pay support? This question is at the heart of Boston v. Boston (2001 SSC 43).

Introduction to Boston v. Boston

- The parties separated after 36 years of marriage. Mr. Willis Boston (“Mr. Boston”) was the primary wage earner, while Ms. Shirley Boston (“Ms. Boston”) managed the household and raised the Boston family’s seven children.

- When the parties separated Ms. Boston took ownership of the matrimonial home, and Mr. Boston kept his pension plan. In addition, Mr. Boston agreed to pay Ms. Boston $3,200/month in spousal support.

- Six years after separation, Mr. Boston retired and began collecting a pension of $8,000/month. Mr. Boston then filed for a motion to reduce his support payments under a change of circumstance.

- In retirement, Mr. Boston’s only significant source of income was pension income of $8,000 per month. Of this $8,000 in pension income, $5,300 was earned during the marriage and was therefore previously equalized.

Introduction to Double Recovery

The term “double recovery”, sometimes referred to as a “double dip”, is used to describe a situation where an asset, such as a pension, is equalized upon the dissolution of marriage and then subsequently treated as income to pay support.

In Boston v. Boston, Ms. Boston received an equalization payment that included the value of Mr. Boston’s pension plan. If she subsequently received a portion of Mr. Boston’s pension income through payments of spousal support, she would be recovering twice from the same asset.

When is Double Recovery Permissible?

The Courts may view a double recovery as permissible when support is assessed on a needs basis, and may not be permitted when assessed under a compensatory basis, though exceptions apply in both situations.

Compensatory Basis for Support: Compensation for economic hardship suffered by a spouse because of the breakdown of marriage. Examples of support assessed on a compensatory basis may include a spouse who sustained economic disadvantages the marriage (for example: a spouse that does not work, or works reduced hours, in order to manage the household may have reduced future earning potential as a result of the marriage).

Non-Compensatory (Needs) Basis for Support: Payment to a spouse to allow them to maintain basic living standards. Examples of support assessed on a needs basis may include a spouse who, without support, is unable to support themselves; and

In addition, we understand that the Courts may view double recovery permissible when assessing child support.

Application of Double Recovery in Boston v. Boston

- Boston has established a needs basis for support, and this was not disputed by Mr. Boston. However, the needs basis for support was limited, and the portion of support payments in dispute were viewed as compensatory.

- The Supreme Court of Canada disallowed double recovery on the equalized portion of the pension, stating that it would be inequitable to allow Ms. Boston to reap the benefits of the pension first on the division of the assets, and again on support payments.

- Boston received capital assets from the equalization, which have maintained their value. On the other hand, the Mr. Boston’s major asset (his pension) is diminishing. Without relief, Ms. Boston would accumulate an estate while Mr. Boston would not.

- The court ordered Mr. Boston to continue paying support on the unequalized portion of the pension. In the view of the court, this would satisfy the needs basis for any support payments.

Final Thoughts

When support plays a compensatory role in a marriage breakdown, the majority of the Court held that it would not be fair to divide the property upon separation, and then expect one spouse to support the other with their share of the divided property. When support is based on need, different considerations may apply.

If you need help navigating the complicated areas of business valuation and income available for support, the experts at Davis Martindale can help you. Give us a call today for a personalized discussion.

Co-Authors

Ron Martindale

BASc, CPA, CA, CBV, CFF

Partner

Valuation & Litigation

Louise Poole

CPA, CA, CBV, CFF

Partner

Valuation & Litigation

Work With Us

Our Valuation Advisors are ready to have

a personalized discussion with you.