Prince’s Estate – through the Lens of a Valuator

Prince’s Estate – through the Lens of a Valuator

In this blog we discuss Prince’s business valuation dispute, and shed some light on the complexity of his estate’s probate proceedings.

Valuation disputes between income tax authorities and estates can often occur in probate proceedings, which can result in hefty legal fees, accounting fees, and even penalties. One of the key contributing factors to the complexity and chaos of Prince’s probate proceeding is a difference in the valuation experts’ opinion of fair market value.

Prince and His Death

Prince Rogers Nelson – “Prince”, was an American singer-songwriter. He was considered one of the greatest musicians of his time, and most people can name a few of Prince’s number one hits. His music shaped the North American music industry and still has a profound impact today.

Prince’s death from a fentanyl overdose on April 21, 2016 shocked and saddened many of us. And with an estimated net worth of anywhere up to US$300 million[1], Prince’s estate has undergone one of the most complicated probate proceedings in Minnesota’s history.

The Estate’s Valuation Dispute

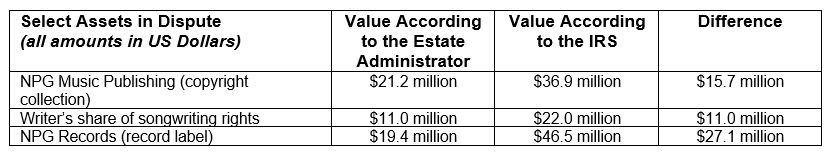

Why are Prince’s probate proceedings so complicated, resulting in tens of millions of legal fees, consulting fees, and penalties? The dispute mainly relates to the valuation of Prince’s estate. According to the IRS, Prince’s estate administrator undervalued the estate’s assets by approximately US$80 million, which means an additional US$32.4 million in federal estate taxes. Some of the specific assets with disputed values are[2]:

How can there be such a disparity in the value of these assets?

Back to Basics

From a Chartered Business Valuator’s perspective, the value of an asset is the present value of total future cash flows expected to be generated by the asset. The discount rate considers the time value of money and the risks associated with generating the cash flows. In other words, there are two key variables – future cash flows and risk.

For Prince’s estate, much of the future cash flow relates to his music. But quantifying the future cash flows and related risks has proven to be incredibly challenging and as a result, the estate administrator and the IRS have very different ideas about the value of the assets held by the estate. The Minnesota Court system will eventually resolve this, but some contributing factors make it particularly difficult to value the estate’s assets.

Some Complex Valuation Components

Although valuing even an uncomplicated business can be difficult, valuing Prince’s estate is particularly challenging because:

- An artist’s music sales usually spike by 50% or more after death[3]; therefore, at the time of Prince’s death, past sales don’t necessarily reflect anticipated future sales. And this spike did happen for Prince, as he was consistently ranked in Forbes’ top 10 highest paid deceased celebrities every year between 2016 and 2020 (Michael Jackson was always #1).

- However, these post-death surges in sales aren’t always sustainable, as people’s interests and tastes change. It is difficult to estimate how long these surges will last.

- Prince died with a sealed underground vault full of previously unreleased music. When the vault was finally opened, the estate discovered there was enough music to release a posthumous album every year for the next century[3]. But whether fans will still buy Prince albums 50 or 100 years from now is certainly up for debate.

With the combination of variables and uncertainties around future cash flows and risk, it’s no wonder the value is uncertain.

Take-away

A business valuation for family law or corporate commercial litigation purposes can be straight forward, or it can be as complex as in Prince’s case. In order to navigate through the chaos and regardless of the complexity, we always need to go back to the fundamentals – the underlying cash flow and related risks.

If you need help navigating the complicated areas of business valuation, the experts at Davis Martindale can help you. Give us a call today for a personalized discussion.

Co-Authors

Ron Martindale

BASc, CPA, CA, LPA, CBV, CFF

Partner

Valuation & Litigation

Korab Ferati

CPA, CMA, CBV

Manager

Valuation & Litigation

Information Sources:

[1] https://www.nbcnews.com/pop-culture/music/irs-says-prince-s-estate-was-undervalued-80-million-n1252690

[2] https://www.nytimes.com/2021/01/04/arts/music/prince-estate-taxes.html

[3] https://www.investopedia.com/articles/insights/042416/how-much-prince-worth-after-his-death.asp

Work With Us

Our Valuation Advisors are ready to have

a personalized discussion with you.