Trusts: Part III – Beneficiaries

Trusts: Part III - Beneficiaries

In this blog, Part III in our Trusts Series, we explore the two types of beneficiaries and how different scenarios surrounding the beneficiaries may impact family law.

As discussed in our previous blogs, Trusts: Part I, and Part 2, trusts are a common estate and tax planning tool, and are often used to transfer wealth to a beneficiary or beneficiaries. Dealing with trusts in a financial structure introduces an additional layer of complexity. In this blog, we explore the two types of beneficiaries and how different scenarios surrounding the beneficiaries may impact family law.

Types of Beneficiaries

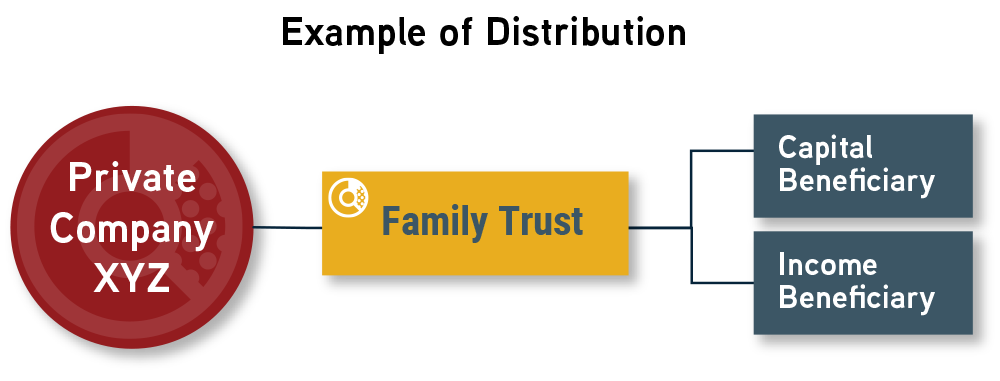

A beneficiary of a trust can be an individual or an entity. The two types of trust beneficiaries are:

- Income Beneficiary: have rights to the income generated by the capital owned by the trust. The income may be comprised of interest or dividends on shares owned by the trust, etc.; and

- Capital Beneficiary: have rights to the underlying assets, or trust capital. This includes property contributed (settled) to the trust, and property acquired by the trust, and may be in the form of investments, real property, undistributed cash, etc., owned by the trust.

Scenario A: Private Company XYZ pays $100,000 cash dividend to the Family Trust. The Trustees of the Family Trust then decide to pay the dividend to the income beneficiaries as a distribution of the Family Trust’s income. By distributing the dividend to its beneficiaries, it is no longer taxable to the Family Trust, and is instead, taxed on the income beneficiaries’ tax returns. Special income tax provisions ensure that the distributions from the Family Trust retain the tax characteristics of dividends when received by the beneficiaries.

Scenario B: The Trustees of the Family Trust decide to transfer the shares of Private Company XYZ to its capital beneficiaries as a distribution of its capital. Generally, the transfer of the Private Company XYZ shares to the capital beneficiaries occurs on a tax deferred basis.

Trust Beneficiaries and Family Law

When determining income available for support purposes, it is important to consider the impact of a trust. Distributions received from trusts may be available for support purposes, and in certain circumstances it may be advisable to have a CBV assist in the calculation of an individual’s income.

Income received by the income beneficiaries from a trust is reported on the individual’s tax return (unless a capital dividend was received), and the income could be considered available for support purposes.

The trust could earn income that is not distributed to the income beneficiaries during the period, as income distributions are made at the discretion of the trustee. The income earned by the trust, but not distributed to the beneficiary, could also be considered in determining income available for support.

In our blog, Trusts: Part II – Determining Control, we discuss several factors that influence the control of the trust including 1) original intent, 2) degree of control over the trust, and 3) past activity of the trust. These factors influence what may be considered available from the trust for income for support purposes. For example, if the income beneficiary is also the sole trustee of the trust, that individual has control over the income distributions from the trust and can choose whether or not to make a distribution from the trust. In that situation, an argument could be made that the income in the trust is available to that individual. However, if the beneficiary is not a trustee and has historically not received any of the distributions from the trust, the income in the trust could be considered not available to that individual.

Dealing with Family Trusts may add an extra layer of complexity to family law matters. The experts at Davis Martindale can help you, give us a call today for a personalized discussion.

Co-Authors

Ron Martindale

BASc., CPA, CA, CBV, CFF

Partner

Valuation & Litigation

Terri-Lynn Eckel

Associate

Valuation & Litigation

Work With Us

Our Valuation Advisors are ready to have

a personalized discussion with you.