Understanding Accounting Concepts: Retained Earnings

Understanding Accounting Concepts: Retained Earnings

In this blog, we discuss how retained earnings are calculated, how they can be interpreted, and how they are used in the context of business valuations and family law.

When a company reports net income at the end of any given year, the company has two choices regarding what to do with that net income:

- Distribute it among shareholders in the form of dividends; or

- Retain the earnings within the company.

In general, retained earnings is the summation of all the net income that a company has generated since the inception of the business, less any dividends paid. In the case of a net loss, retained earnings is decreased by the amount of the net loss. When considered over a number of years, retained earnings can be referred to as “accumulated profits”.

Many people might assume that one’s retained earnings is a cash account holding funds that can be withdrawn at any point…However, that’s not true.

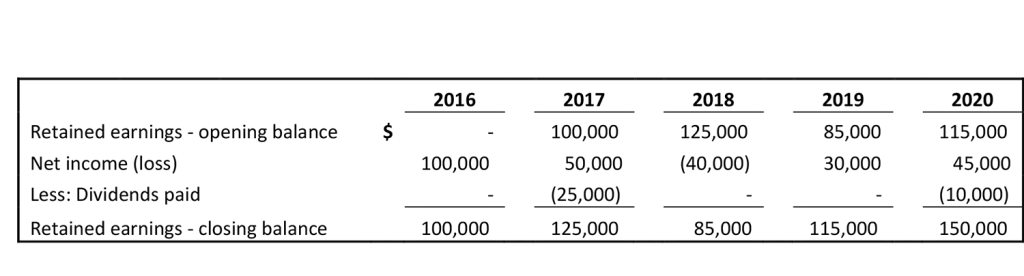

Let’s look at an example of how retained earnings is calculated:

Since retained earnings is simply the measure of reported year-end net income, less any dividends paid, it does not indicate what assets the retained earnings is funding. For instance, income generated by the company could be used to fund the working capital needs of the business, purchase capital assets, or service debt, among other uses.

Take fiscal year 2017 in the above table, for example. The closing retained earnings balance of $125,000 is the cumulation of 2016 net income of $100,000, plus 2017 net income of $50,000, net of the dividends paid out in 2017.

Retained Earnings as a Measure of Value

On the balance sheet, retained earnings is part of the shareholder’s equity section. Shareholder’s equity is the difference between the net book value of the company’s assets and the company’s liabilities. If shareholder’s equity is positive, it means that the company has more assets than liabilities.

Since retained earnings typically comprises the bulk shareholder’s equity, it is approximately equal to the net book value of assets minus liabilities. In this sense, retained earnings represent the book value of the company above and beyond its financial obligations. Because of this, retained earnings can be an important indicator in determining a company’s value if there is no expectation of goodwill. It is important to note that retained earnings represent the net book value of a company’s assets net of liabilities, and not the fair market value; however, retained earnings can be a good starting point in determining value.

For example, consider when a business is valued using an adjusted book value approach (see our blog, Adjusted Book Value Approach). In this case, we begin by relying on shareholder’s equity as at the valuation date to form the basis of value for the company. We then adjust the net book value of the company’s assets to reflect fair market value, among other adjustments in order to determine the company’s total fair market value.

Retained Earnings Misconceptions

Retained earnings is sometimes misinterpreted to be a company’s net income for the year or a cash account of funds available to be withdrawn from the company. As discussed above, retained earnings is neither of those. While a company’s retained earnings balance includes the net income for that period, it also includes the company’s net income for previous periods, net of any dividends paid. Retained earnings also does not represent an account of funds available to be withdrawn as it is common practice for a business to use its retained earnings to fund operations and invest in the business.

If you need help navigating the complicated areas of business valuation, the experts at Davis Martindale can help you. Give us a call today for a personalized discussion.

Co-Authors

Louise Poole

CPA, CA, CBV, CFF

Partner

Valuation & Litigation

Mike Bushell

Associate

Valuation & Litigation

Work With Us

Our Valuation Advisors are ready to have

a personalized discussion with you.