Valuation Approaches: The Adjusted Book Value Approach

Valuation Approaches: The Adjusted Book Value Approach

As the first of three blogs in this collection, this blog will take a detailed look at the adjusted book value approach, including the circumstances in which it may be used and how it is calculated.

(Updated with current content from our original post on July 13, 2021)

As Chartered Business Valuators (“CBVs”), one of the most common questions we get asked is, “how will my business be valued?” The answer – like most things in life – is “it depends”. That said, we understand that this answer is not particularly helpful for most of our readers. To give you the clarity you need and tackle this topic with the attention it warrants, we’ve created a 3-part blog series: Standard Processes in Valuing Your Business. This series intends to provide readers with a background on the three standard approaches to valuing a business: the adjusted book value approach, the income approach, and the market approach.

As the first of three blogs in this collection, in this blog, we will examine the adjusted book value approach, including the circumstances in which it may be used and how it is calculated.

What is the Adjusted Book Value Approach?

As the name suggests, the “adjusted book value approach” involves adjusting the business’ assets and liabilities to their fair market values – with the surplus of assets (after considering disposal costs and income taxes) representing the going concern value of the business.

When is the Adjusted Book Value Approach Used?

The adjusted book value approach represents the value of a business as a going concern when there is no expectation of any type of commercially transferable goodwill.

Before we dive into the adjusted book value approach, let’s first take a look at the concept of “goodwill”. Goodwill represents the benefits that a potential purchaser can obtain in an acquisition that is above and beyond the business’ net tangible assets. In other words, it is the premium that a buyer is willing to pay for a business, over and above its physical assets. Goodwill may include favourable branding, established products and service lines, customer relationships, and reputation within the industry, among others. For a detailed discussion on goodwill, refer to our blogs The Building Blocks of Value: Goodwill and Intangible Assets and A Deep Dive into Goodwill.

An adjusted book value approach is generally used when there is no reasonable expectation of commercial goodwill.

Sample Situations

There are three common scenarios where the adjusted book value approach may be appropriate:

Scenario 1: The company is an investment or real estate holding company;

Scenario 2: The company has active business operations that do not generate sufficient earnings to realize a reasonable return on the net assets;

Scenario 3: The company is an operating business where all of the income is attributable to personal goodwill.

In the first scenario, consider a real estate holding company that owns a rental house in the suburbs of London. When a potential buyer purchases the company, they are unlikely to pay for anything greater than the fair market value of the physical building – as there is nothing proprietary about the company, nor is there anything that differentiates this rental company from all the others. In this scenario, the company’s value is really tied to the building, not the building’s earning capacity. Thus, the adjusted book value approach is appropriate.

In the second scenario, a real estate development company holds a piece of vacant land for future development. To generate some income, a parking lot is temporarily put on the land; however, the present value of the annual income generated by the parking lot is far less than the fair market value of the land. This means the business is not generating sufficient earnings to realize a reasonable return (i.e. the asset is not being put into its best use). For example, if a piece of land is bought for $500,000 and it is generating annual income of $50,000, a CBV may use market research to determine that a 5x multiple of earnings is appropriate. Accordingly, the “value in use” of the parking lot will be $250,000 ($50,000 x 5), which is far less than the parking lot’s tangible asset backing of $500,000. As a result, the adjusted book value approach is more appropriate in this scenario because it will result in the highest value for the company.

In the final scenario, consider a company that is based exclusively on an individual’s personal reputation. For example, a self-employed hair stylist has served the community for 30 years and is well known for her aesthetic taste. A potential buyer may not be able to attract and retain the same clients, and therefore he/she may not be willing to pay a “premium” for the business. In other words, the personal goodwill associated with the current owner may not be transferable. Accordingly, an adjusted book value approach may be appropriate in this circumstance.

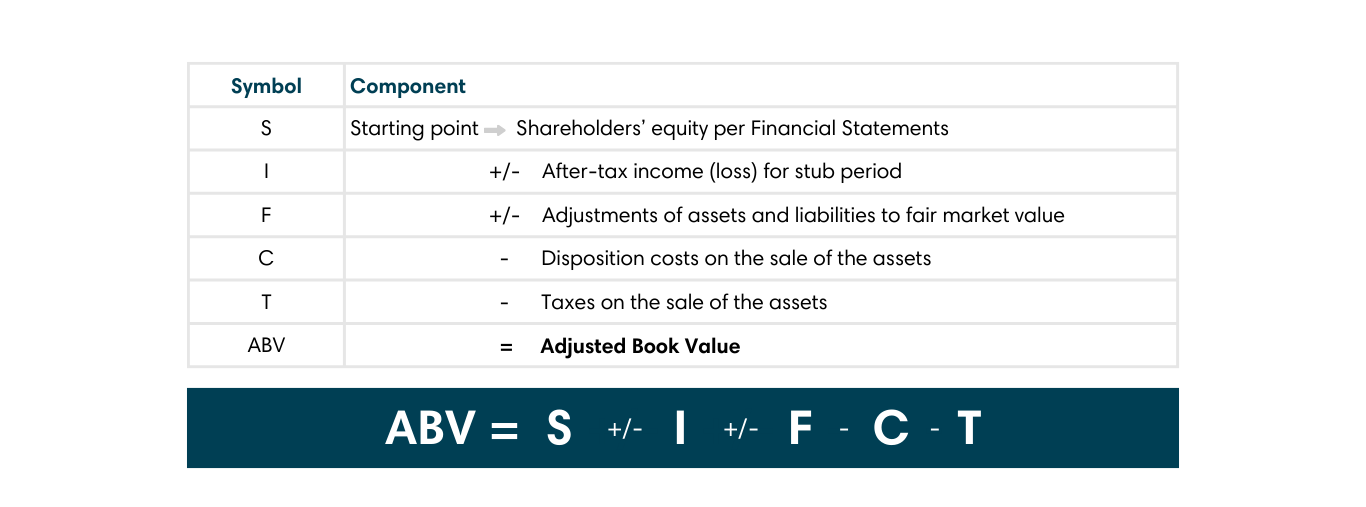

The Formula for an Adjusted Book Value Approach

Below is a formula of how we calculate the adjusted net book value. We start with the shareholders’ equity on the financial statements, add any stub period after tax income/losses, adjust assets and liabilities to the fair market value as at the valuation date, and consider any disposition costs and income taxes arising from the notional sale. We then arrive at the adjusted net book value of the business.

If you need help navigating the complicated area of business valuation, the experts at Davis Martindale can help you. Give us a call today for a personalized discussion.

Co-Authors

Louise Poole

CPA, CA, CBV, CFF

Partner

Valuation & Litigation

Janece Boersma

CPA, CBV

Senior Manager

Valuation & Litigation

Work With Us

Our Valuation Advisors are ready to have

a personalized discussion with you.