Why Do I Need a Valuation? Family Law

Why Do I Need a Valuation? Family Law

In this blog, we discuss how a valuation can help to determine a fair value for your business when going through a divorce, separation or annulment of a marriage.

(Originally Posted June 12, 2017)

Divorce can be complicated, and if you own a business it can be even more confusing. If you owned a business when you got married, when you got separated or both, your lawyer will likely request a business valuation be prepared by a Chartered Business Valuator.

Why would your lawyer want even more information than you’ve already provided?

When going through a divorce, separation, or annulment of a marriage, one spouse may have the right to receive payment from the other spouse in order to “equalize” the property owned between them. This is usually called an “equalization payment.”

Put simply, the property considered for equalization is:

- The value of each spouse’s property when they separated,

- Less the market value of each spouse’s property when they got married.

The difference in total value between the higher-value spouse and the lower-value spouse is then equalized.

Equalization Payment Example

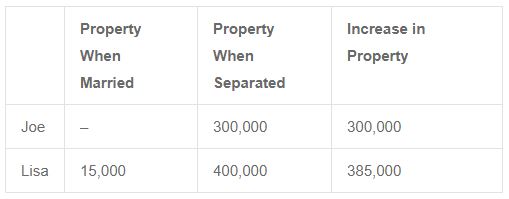

Consider Joe and Lisa’s situation. Joe and Lisa were married in 2000 and separated in 2015. They both entered the marriage and left the marriage with different amounts of property:

Over the course of the marriage, Joe’s property increased by $300,000 and Lisa’s property increased by $385,000. In order to equalize these increases, Lisa would pay $42,500 to Joe, which is half of the difference between her increase and his increase. This way, both Joe and Lisa leave the marriage $342,500 richer than when they got married.

Why Involve a Valuation Expert?

Many types of property, such as bank accounts and investments, are easy to equalize because the value is easily determinable and they may be liquid. Property such as an ownership interest in a business, however, can be much more difficult to value and often requires the involvement of experts.

If part of the property Joe or Lisa owned when they got married was an interest in a business, then the value of the business needs to be determined. Often the owner of a business thinks they have a rough idea of what their business is worth. However, that rough idea tends to be biased either too high (the owner may have unrealistic expectations of the earnings potential of the business) or too low (the business owner may want to minimize the equalization payment).

To achieve a bias-free value, a Chartered Business Valuator can be hired to provide the business’s value. If you feel you need a valuation for your separation agreement, give us a call and we’ll help you with the process.

Co-Authors

Louise Poole

CPA, CA, CBV, CFF

Partner

Valuation & Litigation

Ron Martindale

BASc, CPA, CA, CBV, CFF

Partner

Valuation & Litigation

Work With Us

Our Valuation Advisors are ready to have

a personalized discussion with you.